I recently moved to Costa Mesa because it’s a nice city with housing prices slightly less absurdly high than the rest of Orange County. It should be called Costa Lotta.

I moved despite knowing the city government’s finances under Mayor John Stephens are the worst of any city in Orange County. I knew that because for three years, 2017-20, I was the press secretary to state Sen. John Moorlach, until he lost his re-election to Dave “Jobs Killer” Min. And Moorlach for two decades has produced an annual Report Card on the finances of Orange County’s 34 cities.

I didn’t know it when I moved here, but Moorlach soon would announce he’s running for mayor to correct the massive deficits run up by Stephens and his predecessor, Katrina Foley. She has carried her budget-wrecking ways to the OC Board of Supervisors after defeating Moorlach last year. She’s currently is running against Pat Bates, a state senator who worked closely with Moorlach to try to keep California’s fiscal house in order.

Unless Moorlach beats Stephens, I’m considering getting out of this insane state. Three strikes against Moorlach and I’m out.

Moorlach’s campaign website is here. Contribute what you can. And support Bates here.

As he first showed me about two decades ago at the old OC Register building at 625 N. Grand Ave. in Santa Ana, the key number in city budgets is the “unrestricted net position” from the Annual Comprehensive Annual Report. A positive net position is good; a negative net position is bad, especially if it’s high, indicating risk of bankruptcy. Conveniently all of the reports now are online.

He last updated his figures on his blog in August. Costa Mesa ranked dead last of OC’s 34 cities, with an unrestricted net deficit of -$243,934,825 for the fiscal year ending June 30, 2021. The city has a population of 112,780. So the per capita number is -$2,163. A family of four owes -$8,652.

In an OC Register story on the Moorlach-Stephens combat, Stephens explained why the city’s finances under his administration actually are in great shape: “Stephens dismissed Moorlach’s dismal view of the city’s financial position, noting that cities like Costa Mesa that provide most services in-house have to carry pension debt on their books, while cities that contract for police, fire and other services don’t.

“The current budget is balanced, and the city didn’t have to spend its reserves when revenue shrunk due to the pandemic, because the council acted quickly to cut services and furlough employees, Stephens said.”

But it’s irrelevant whether or not Costa Mesa is a contract city — meaning it provides its own fire, police and other services instead of contracting out for them — because debt is debt. And Laguna Beach is not a contract city, but scored Nos. 2 on Moorlach’s list with a positive net positions of $38 million. So it can be done. And Costa Mesa enjoys the giant sales-tax inhalers of the South Coast Plaza Experience and numerous car dealerships.

Costa Mesa’s current budget is “balanced” in the same way a family “balanced” its family budget by paying for the lavish vacation to Oahu by running up the credit cards.

And whereas budgets can change as the fiscal year proceeds, an ACFR is an independent audit performed by an outside accounting firm.

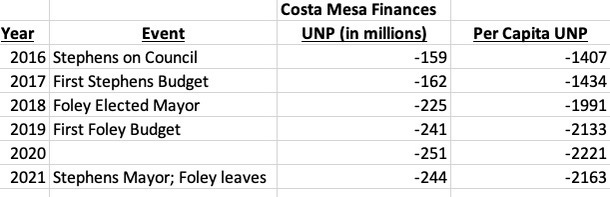

Let’s also look at Costa Mesa’s ACFR performance under Stephens and Hurricane Katrina. Throughout this period, the city’s population was stable, at about 113,000.

Stephens first was elected to the Council in 2016, when the per capita deficit was -$1,407. But the first budget he could influence ended on June 30, 2017, when the per capita deficit started going bad, to -$1,434.

Foley was elected mayor in 2018. But her first budget was the next year, 2019, when the per capita deficit really started getting worse, to -$2,133.

The last fiscal year we have so far ended on June 30, 2021, when Foley left in March and Stephens was appointed mayor, the year clocking at a per capita deficit of -$2,163, a slight drop. Hooray!

But that last number, $-2,163, was up $756 from the -$1,407 of 2016, when Stephens was elected. That’s a deficit rise of 53% in just five years. Not so good.

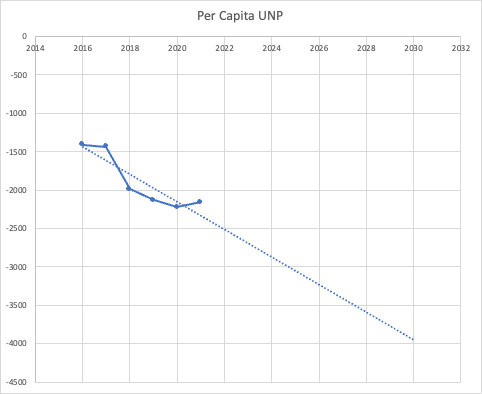

Let’s throw in a trendline on a graph and extend it out to the year 2030.

As you can see, the per capita deficit will rise to $4,000 per person, or $16,000 per family of four, by 2030. Somebody needs to cut up Costa Mesa’s credit cards.

Now, let’s turn to San Bernardino, which declared bankruptcy in 2012. In 2011, its ACFR (then called a CAFR) showed an unrestricted net deficit of $291 million on a population of 210,000. For an per capita deficit of -$1,385. We’ve had some inflation since then, especially lately under Stevens’ and Foley’s fellow Democrat, Joe Biden. So let’s adjust for inflation using the U.S. Bureau of Labor Statistics’ CPI Inflation Calculator. Inflation-adjusted, San Berdoo’s per capita deficit now becomes -$1,814. Costa Mesa’s -$2,163 for 2021 was worse.

Let’s now look at Stockton, which also declared bankruptcy in 2012. Its ACFR for 2011 showed an unrestricted net deficit of -$169 million. Population then was 292,262. Per capita deficit comes to -$578. Adjusted for Bidenflation, we get -$757. Again, that’s not as bad as Costa Mesa’s -$2,163 for 2021.

We can’t predict the future, but bankruptcy for Costa Mesa even could be as bad as Detroit’s in 2013. I’ll spare you the numbers. But that one was so bad a federal judge ordered a “haircut” for public-employee pensions. I hope the unions backing Stephens realize his policies also could lead to reductions in their pensions during a bankruptcy. And with a recession rushing at us, does anyone know how bad things will get? Better than the recession the produced those 2012-13 bankruptcies? Worse? A Greater Depression?

Back in 1994, John Moorlach was running for Orange County treasurer-tax collector, warning the county was about to go bankrupt. Voters didn’t listen and instead re-elected incumbent Bob “Roulette” Citron. Then the county went bankrupt.

Moorlach is warning the same about Costa Mesa. This time, will voters in the City of the Arts listen?