Kudos to Javier Milei for winning the Argentine presidency on a platform of sound money, low taxes and slashing government spending. Like me, he’s a follower of Austrian economist Murray Rothbard, whose “Man, Economy, and State” I first read at Hillsdale College, 1975-77.

But Milei needs to make one key policy change. Instead of switching the national currency to the U.S. dollar, he should return the Argentine peso to the gold standard.

The hazard is following the failed dollarization path Argentina tried two decades ago. As Ananya Bhattacharya wrote this week on Quartz, “Although Argentina hasn’t tried full dollarization, a ‘convertibility plan’ pegged its peso to the US dollar from 1991 to 2002 in an attempt to curb hyperinflation and fuel economic growth.

“It worked—until it didn’t.

“A decade on, ‘fiscal deficits and debt weren’t reined in’ and ‘Argentina lost external competitiveness. Growth collapsed while unemployment and the current account deficit soared,’ Mark Sobel, the US chair of the Official Monetary and Financial Institutions Forum (OMFIF), wrote in August.”

It makes no sense to exchange one fiat currency for another.

The Yankee Peso

Although the dollar is not as inflationary as the peso, it’s still inflationary. According to the U.S. government’s own Consumer Price Index Inflation Calculator, today it takes $754.10 to buy what $100 bought in August 1971. That’s the month President Nixon took the dollar off the gold standard.

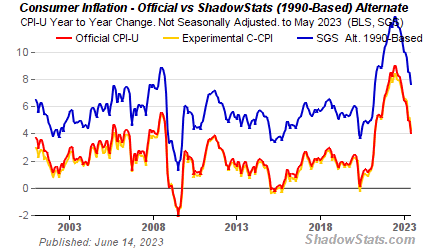

But that’s really an underestimate. According to John Williams’ ShadowStats.com, since the 1990s the government has rigged the numbers to underestimate inflation. Using the pre-Clinton algorithm, inflation is roughly twice what they’re telling us. Here’s a chart from his excellent site (Courtesy of ShadowStats.com):

Note the blue line showing the real CPI. It shows real inflation is around 12% in the United States, and was 17% last year. That’s obviously what all of us are paying at the grocery store, at the gas pump and for the mortgage or rent.

If we look at the dollar’s price in gold, it has soared from $35 an ounce in 1971, to $2,007 on Nov. 21, 2023. It’s worth just 1.7% what it was 52 years ago.

It would be a big mistake for Milei to import that chaos into Argentina. Adopting gold would be a better way to go.

Abandoning Gold and Imposing Peronism

Indeed, abandoning gold was the beginning of the country’s problems. According to Klaus Friedrich Veigel in “The Great Unraveling: Argentina 1973–1991,” “Earlier than most countries, Argentina abandoned the gold standard in December 1929 and adopted protectionist trade measures and active state involvement in the economy. These measures helped shield Argentina from the worst consequences of the Depression. However, it also marked the beginning of a new model of economic development based on import substituting industrialization, which would undermine Argentina’s economic growth and result in permanent economic instability.”

The last two sentences contradict one another. If abandoning gold “helped” Argentina, but then “would undermine” its economy, how is that good? Obviously abandoning gold was a disaster.

In any case, abandoning gold in 1929 paved the way for Peronist socialism, which struck in 1943 when a military coup put him in power atop the Ministry of Labor. He became president in 1946 and the country really never has recovered since.

Dan Mitchell wrote on Mises Wire in 2018, “How Juan Perón's Left Populism Destroyed Argentina's Economy,” displaying this graph:

Mitchell’s analysis: “As you can see, the country used to be much richer than Brazil and considerably richer than Japan. And all through the first half of the 20th century, Argentina was not that far behind the United States and other wealthy nations. But then look at the lines starting after Perón came to power in the late 1940s.

“In other words, Peronist policies reduced the comparative prosperity of the ordinary people.

“Just like similar policies have reduced the comparative prosperity of ordinary people in Venezuela.

“What makes these numbers especially powerful is that convergence theory assumes that the gap between rich nations and poor nations should shrink. Yet statist policies are causing the gap to widen.”

What Kind of Gold Standard?

There are many types of gold standard. Milei has a short time to implement his reforms. And if he doesn’t quickly end the inflation, he will fail at everything else. He should implement two practical, achievable polices everyone can understand.

First, pass a law requiring the Argentine Central Bank to peg the peso to its value in gold on his first day in office, Dec. 10. As I write, the current value is 713,768 pesos per ounce of gold. By Dec. 10, that might be something like 800,000.

Second, he should convert a portion, say 5%, of the current national debt of $447 billion to 1.75% gold bonds. The gold bond idea for the United States was proposed by economist David Bostian during testimony before the 1982 Gold Commission, on which Ron Paul served. Bostian said, “I do advocate a gradual and experimental shift toward a possible full gold standard through the issuance of new gold-backed bonds or notes.”

Bostian further explained in a 1989 op-ed in the New York Times, “Bonds with gold convertibility would provide a savings in interest expenses to the Government (and taxpayers) that would be considerable. It is estimated that the Eagle bonds proposed in the gold bond bill would carry an interest rate of only 1.75 percent. The bonds would be attractive to investors even though they would pay such low rates because the gold backing to the bond would serve as a hedge against inflation and preserve the investor's buying power. If the bonds were well received by the market, a phased-in conversion of all Government bonds to gold-backed bonds – which might take five years – could result in interest expense savings averaging as much as $150 billion a year. This savings would substantially eliminate the Federal budget deficit.

“Bonds with gold convertibility would provide a savings in interest expenses to the Government (and taxpayers) that would be considerable. It is estimated that the Eagle bonds proposed in the gold bond bill would carry an interest rate of only 1.75 percent. The bonds would be attractive to investors even though they would pay such low rates because the gold backing to the bond would serve as a hedge against inflation and preserve the investor’s buying power. If the bonds were well received by the market, a phased-in conversion of all Government bonds to gold-backed bonds – which might take five years – could result in interest expense savings averaging as much as $150 billion a year. This savings would substantially eliminate the Federal budget deficit.”

For Argentina, if 5% of the debt were convernted to gold-backed bonds, effectively those bonds would become an alternative, gold-backed currency. If that experiment succeeded, which it likely would, then the full debt could be converted to gold. Of course, the country also would have to stop all debt spending – admittedly a hard task.

Milei’s job isn’t easy. But it will become much harder if he switches from the Argentine peso to the Yankee peso – the dollar. Instead, he should go for gold.

Argentina attaching itself to the U.S. dollars is like throwing an anchor to a drowning man. When the U.S. dollar is dethroned as the world’s reserve currency and all those counterfeit dollars used to buy real products created by others come flooding back to the U.S., you don’t want to be connected in any way to the best fiat horse in the glu factory.

If he really tied the peso to gold, that would win. By contrast, the dollar would keep inflationg. But can he do it? That's the question. My guess is not.